These crowdfunding offers an item in return to have donations otherwise a monthly subscription to the business. Additional benefits are supplied according to number of share otherwise subscription in the customers. The funds must be to possess a particular purpose, and that should be certainly mentioned at the beginning of the brand new strategy.

Equity-created Crowdfunding

Equity-oriented crowdfunding lets users to receive offers of your team as due to their share. These crowdfunding can be very tricky, and it’s really recommended that a family look for legal advice prior to wanting to raise money due to guarantee-founded crowdfunding.

- Collateral We: This must be done myself thanks to accredited buyers. Business owners using this crowdfunding access this new fewest prospective investors and you will deal with at least quantity of judge legislation.

- Security II: This one makes you promote your crowdfunding options in public places, you could however just take on money from certified people.

- Guarantee III: This one makes you advertise your crowdfunding needs and you can specifications publicly, and you can undertake money from just about anyone. This one is heavily controlled by the You Bonds and you may Replace Payment (SEC) to protect the latest welfare away from newbie investors.

Several legislation regulate collateral-established crowdfunding. Such laws are in spot to manage the latest welfare out-of dealers since the many are beginner with this specific types of expenses.

Almost every other examples of collateral-centered crowdfunding is angel traders, who happen to be rich people whom give capital in return for an possession express, and you can strategy capitalists, that are groups of investors whom invest to possess a portion off security regarding organization.

Exactly who Crowdfunding Is great To possess

Getting firms that are starting something new otherwise lack any money, reward-based crowdfunding is a great answer to increase money. Companies also use crowdfunding to increase coverage.

Equity-built crowdfunding can be used by organizations prepared to stop trying equity to discover the resource had a need to grow rapidly. Yet not, it’s much harder than simply reward-dependent crowdfunding, and you can legal advice can be desired before trying it.

How to locate Crowdfunding

There are various websites readily available for crowdfunding, having Kickstarter and you may Patreon becoming two of the most well known internet sites. All of the crowdfunding site features its own regulations and requirements, therefore look cautiously to make sure they will work effectively along with your startup providers.

No matter what version of startup funding your organization enforce to have, you can help the probability of triumph following this type of four measures.

step 1. Get ready a stronger Business strategy

In advance of an investor otherwise bank causes a business, might would like to know you to a powerful, long-label business strategy is actually place. Additionally, they want to know the business can also be pay back the mortgage according to research by the business strategy and you will monetary projections.

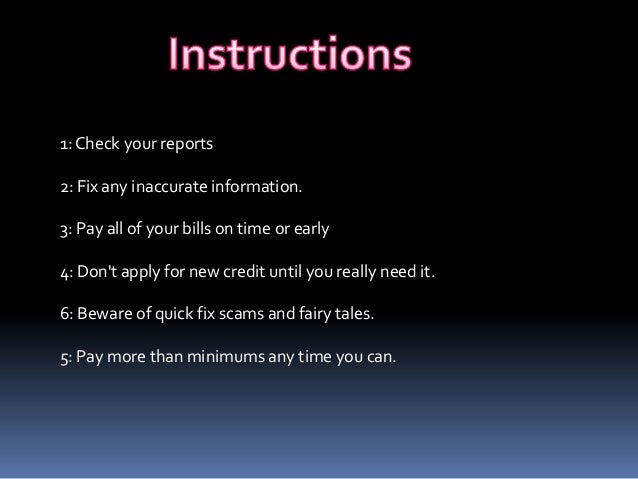

dos. Replace your Individual Credit score

Because so many version of startup capital cover the firm manager providing an individual loan, your credit rating and you can financial situation can get determine whether the organization normally procure startup financial support. Likewise, having limited organization money and you can amount of time in company, the credit and you will earnings should determine the fresh fate of loan software.

step 3. Save Private Investment

Not only can private income and capital be considered when you take aside personal loans for startup funding, however, many version of startup investment need off repayments. Loan providers need entrepreneurs to contribute between 10% and 30%

cuatro. Create the brand new Business’ Clientele

Business people which have an ever-increasing clients will show potential loan providers that company is feasible hence it’ll have the funds to settle the mortgage. Companies that do not have a very good clients can get complications persuading lenders of your own organizations enough time-identity stability.

Commentaires récents